... (...)

Price at calculation:

$...

Current live price:

$...

LIVE

Strategy Performance since calculation:

...

LIVE

•

0 views

Expiration date

i

The expiration date is when an option contract expires. An option contract is a contract to buy (call) or sell (put) an asset at a specific price (strike price) until a specific date (expiration date). This is a read-only snapshot from the shared calculation.

...

Probability Distribution

i

The assumed probability distribution of the stock price at the selected date. The X-axis shows the possible stock prices the stock can assume at the selected expiration date,

the Y-axis represents the probability density for each stock price. The area under the curve represents probability.

✓ Coordinates copied!

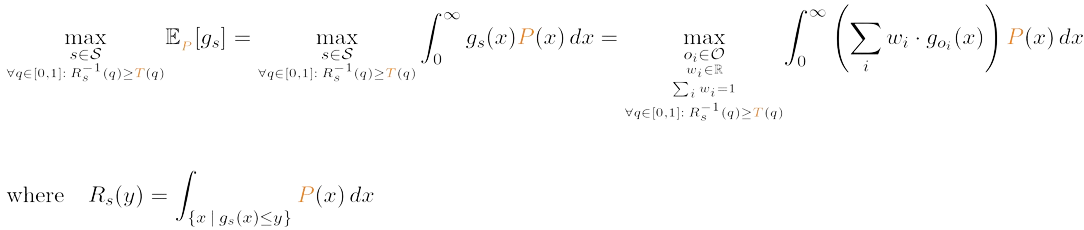

Risk Tolerance

i

The risk tolerance profile used for this calculation. The X-axis represents probability scenarios

from worst case (0%) to best case (100%). The Y-axis shows the minimum acceptable performance for the scenario given by the X-axis.

Negative values indicate maximum acceptable losses, positive values show minimum required gains.

Read-only snapshot from the original calculation.

Search Parameters

i

The parameters used for the option strategy search. These settings determined how thoroughly

the algorithm searched for the optimal spread (combination of options) to maximize expected profit while meeting the risk tolerance.

▼

Found Option Strategy

i

This shows the optimal option strategy found by the algorithm. Each line represents one leg of the strategy, showing the weight (percentage allocation), option type (call/put), strike price, and the price to pay for that option.

🔒 In Development

🔒 In Development

✓ Copied!

Strategy Performance Analysis

i

This chart displays the potential profit/loss of the calculated options strategy. For any stock price on the X-axis, the chart shows the profit/loss performance by the selected expiration date of the strategy in percent on the Y-axis. These values are without uncertainty.

The only uncertainty is which stock price will be reached by the selected expiration date.

Black-Scholes Valuation

i

The Black-Scholes valuation is a PDE (Partial Differential Equation)-based, nobel-prize winning method to predict the price of the option before its expiration date. Each cell represents the performance of the strategy for a specific share price (rows) on a specific time before expiration (columns). This is a theoretical performance and the actual performance may vary. The last column shows the performance of the strategy at expiration date and is the same as the above performance chart (rotated 90 degrees clockwise) and without uncertainty. The Black-Scholes valuation has flaws by the nature of idealized assumptions the real market does not follow but it is a good and widely used starting point for option pricing.

Risk Profile Comparison

i

This chart compares the specified risk tolerance (red) with the actual risk profile achieved by the found strategy (blue).

If risk tolerance was included in the Search Parameters, the achieved profile should always be above the

minimum requirements as that represents the risk tolerance being met. The green line shows the Iterative Risk Profile: a simulation of 10,000 successively and iterative investments into the found strategy. In each simulation the found investment is iteratively and successively invested in 20 times and the end result is stored. The 10,000 simulations are sorted from best to worst and displayed here.

🔒 In Development

🔒 In Development

✓ Copied!